It’s a good thing to be in a relationship, especially a healthy one. Everyone wants to be happy, and when one finds such happiness in a relationship, then one should grab the opportunity. Every relationship is marked by certain moments of challenges. In some cases, it could be as a result of infidelity; at other times, it could be as a result of subjugation. One of the partners may even be suffering from delusions of grandeur.

Nevertheless, one of the major causes of problems in relationships is money. As an individual, it’s possible that you have picked some fights with your partner over how or why they spent certain money. It could be the case that they want to purchase a house or car worth $500,000 when the family yearly income is just a little above $60,000. One of you may be hiding your spending from the other.

Don’t panic, you are not the only one facing the ugly situation. Even those that are single often face a similar situation, maybe not with a partner but with a parent or sibling. Despite the fact that you and your partners share certain common qualities, especially intimacy, you may not share the same money habits, goals, and values. Although, you may share debts and other financial challenges.

The following tips will help you handle your finances and relationships more effectively…

1. Discuss financial goals and values with your partner

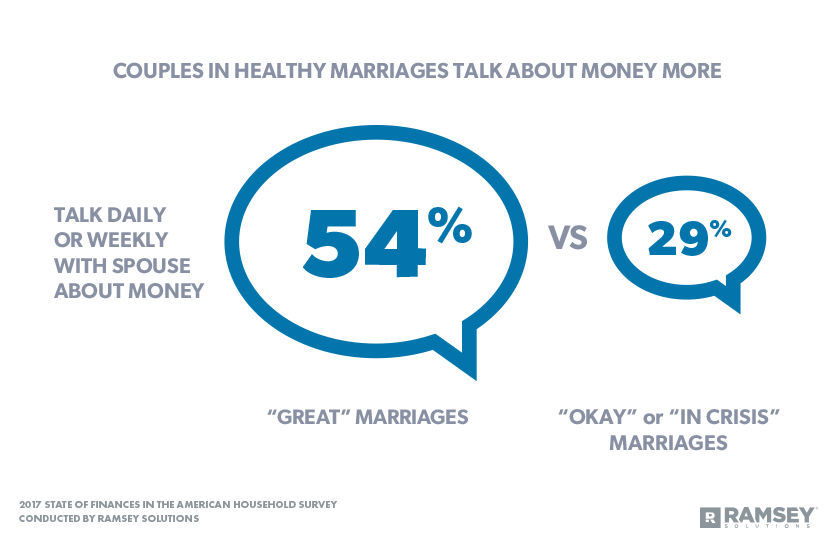

Remember when you were single? You probably always loved to eat outside, purchase the newest electronic gadget, or buy the most expensive outfit. This isn’t bad. However, your status has changed now and you need to make some little adjustments. Part of it is to talk about finances with your partner. As the team that you are, you need to talk about your future – your financial goals and how you can collaborate to achieve them.

To start with, each of you can talk about aspects of your family life that will require money. Some of them may include buying a house, taking care of your kids’ education, buying a car, going on a vacation, funds for emergency situations (such as accident, sickness, etc.), acquiring smart home appliances, clothes, among others. Definitely, both of you will want different things. However, the goal is to reach a compromise.

After creating the list, you should then arrange them in order of importance. Whatever you consider the most important, you must give a good reason to support your conclusion. This tells your partner that you show great concern towards their desires. Always seek a win-win solution. Otherwise, you can compromise in such a way that happiness is gotten by the two parties.

2. Learn about your partner’s money habits

Money habits are usually a reflection of one’s upbringing. It is important that you glean information on your partner’s way of handling money and the current state of finances. This also includes their debt profile, savings goals, and retirement plans. Some financial planners recommend that you consider having a look at your partner’s credit report. Through this, you get a clue about their outstanding debts, loans, and credit card accounts.

Upon confirmation, you may be put off by the revelation. It could be the case that your partner has a huge debt profile and it scared the hell out of you. You shouldn’t panic at this stage. Beyond having some debts, your greatest concern should be what your partner is doing to pay off the debts and fix other financial issues.

3. Be open and honest about money

In many relationships, trust issues are common, especially when money is involved. When your partner lies about money, it becomes financial infidelity. This can result in more financial problems, stress, unhappiness, and, consequently, your life gets impacted negatively. When this gets to a stage where your partner can no longer cope with it, they may file for divorce, and this brings an end to the relationship.

There is a possibility that your partner is being dishonest with you in terms of their financial state. Here are some indicators to look out for: credit cards are being declined; you no longer notice any bills in the mail; your partner is now afraid to talk about money; among other things. As the team that you are, rather than blame your partner, you can always bear each other’s burden, help out where and when necessary, as well as encourage each other. The goal is to be happy together.

Nevertheless, you have to position yourself in such a way that your partner feels comfortable in telling you about their struggles with money.

4. Set spending limits for each other

Spending limits are not limitations. Rather, they help you to stay on track in regards to your budget. Depending on your financial state, you can set your limit as you and your partner find it comfortable. The limits could be on a weekly or monthly basis. For instance, you and your partner can agree that neither of you will spend more than $200 every week. The moment you reach your spending limit before the week runs out, you know that all you have left to spend is your time.

Discuss this with your partner during your financial meetings. Remember communication is an important aspect of every relationship, including marriage.

5. Learn ways through which you can improve your financial situation

How comfortable are you with your present financial state? If you are not, then you need to put on your learning cap. There are different ways through which you and your partner can empower yourselves to improve your financial situation. You can read financial blogs and books; listen to podcasts on finance, budget, and saving; attend workshops, either physically or virtually, among others things.

Through these means, you get exposed to different pieces of financial advice that can help your current financial situation. You also get to know about people who passed through the same situation and how they were able to break through the challenges.

6. Periodically review your financial plan and goals

Financial meetings do not end with the first meeting where you initiated certain plans and goals. They should be held at regular intervals, which may be weekly or monthly, for necessary appraisal. The reality is this, the fact that you now both share the same financial value and goal does not rule out the possibility of one of you falling short in their financial responsibilities.

To avoid missing out on payments, have a weekly meeting where you review your accounts along with your spending plan. They also help you to discover the new items that will be included in your budget or the ones you have to expunge, aspects where you are having some challenges, the level of progress you have made on your debts, among other things. Avoid overlooking this important aspect.

Conclusion

Managing both finances and relationships is not usually fun and can be challenging. However, it is crucial to maintaining a healthy, long-lasting relationship. This means that love is not the only factor that determines a healthy and lasting relationship – money also does. Money doesn’t have to be the basis for the end of your relationship. The earlier you are able to pay attention to money, the better and healthier for your relationship.

Free Gift

Check out the FREE video series on my 3 Keys to Unlocking Your Financial Freedom! This video series touches on Budgets, Tackling Debt, and Ways to Increase Income TODAY! I created this series for those of you who have been hit hard by COVID-19. I want you to know there is nothing you can’t accomplish and creating a plan of action is always a great starting point.